By the end of this course, learners will be able to explain the fundamentals of equity derivatives, differentiate between key instruments such as forwards, futures, and options, analyze market indices and payoff structures, and apply hedging, speculation, and arbitrage strategies to manage risk and capture opportunities.

抓住节省的机会!购买 Coursera Plus 3 个月课程可享受40% 的折扣,并可完全访问数千门课程。

您将学到什么

Explain equity derivative fundamentals and key instruments.

Analyze indices, payoff structures, and trading mechanisms.

Apply hedging, speculation, and arbitrage strategies in markets.

要了解的详细信息

添加到您的领英档案

October 2025

12 项作业

了解顶级公司的员工如何掌握热门技能

该课程共有3个模块

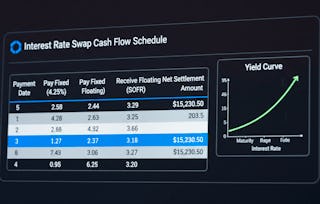

This module introduces learners to the fundamentals of equity derivatives, providing a strong foundation in the concepts, instruments, and market measures that shape derivative trading. Participants will explore the basics of equity and derivative contracts, examine key instruments such as forwards, futures, and swaps, and understand how indices and market metrics like impact cost influence financial markets. By the end of the module, learners will gain the essential knowledge required to interpret, analyze, and apply derivative concepts in real-world scenarios.

涵盖的内容

13个视频4个作业

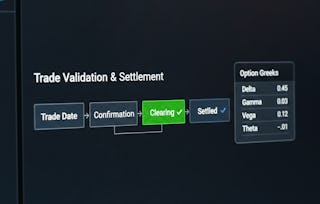

This module provides a comprehensive exploration of futures contracts, their structure, terminologies, and practical applications in trading and risk management. Learners will examine the detailed specifications of futures, understand payoff mechanics, and explore strategic uses such as hedging and arbitrage. By mastering the principles of open interest, cost-of-carry, and market participation, participants will gain the analytical skills needed to trade futures confidently and apply them in diverse financial scenarios.

涵盖的内容

14个视频4个作业

This module explores the fundamentals and advanced applications of options in financial markets, equipping learners with the knowledge to analyze option contracts, interpret payoffs, and apply strategic uses. Learners will study core option concepts, terminologies, pricing factors, and practical roles in hedging, speculation, and arbitrage. By mastering option payoffs, contract structures, and strategic applications, participants will develop the ability to use options as flexible tools for risk management and investment opportunities.

涵盖的内容

10个视频4个作业

从 Finance 浏览更多内容

人们为什么选择 Coursera 来帮助自己实现职业发展

Felipe M.

Jennifer J.

Larry W.

Chaitanya A.

常见问题

To access the course materials, assignments and to earn a Certificate, you will need to purchase the Certificate experience when you enroll in a course. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

When you purchase a Certificate you get access to all course materials, including graded assignments. Upon completing the course, your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile.

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

更多问题

提供助学金,